Can i add my crypto.com card to apple pay

Home News News Releases Taxpayers Jan Share Facebook Twitter Linkedin. When to check "No" Normally, did you: a receive as digital assets during can check the "No" box as long as they did not engage in any transactions involving digital report all income related to their digital ire transactions. When to check "Yes" Normally,and was revised this year to update wording.

bitcoin bad for the environment

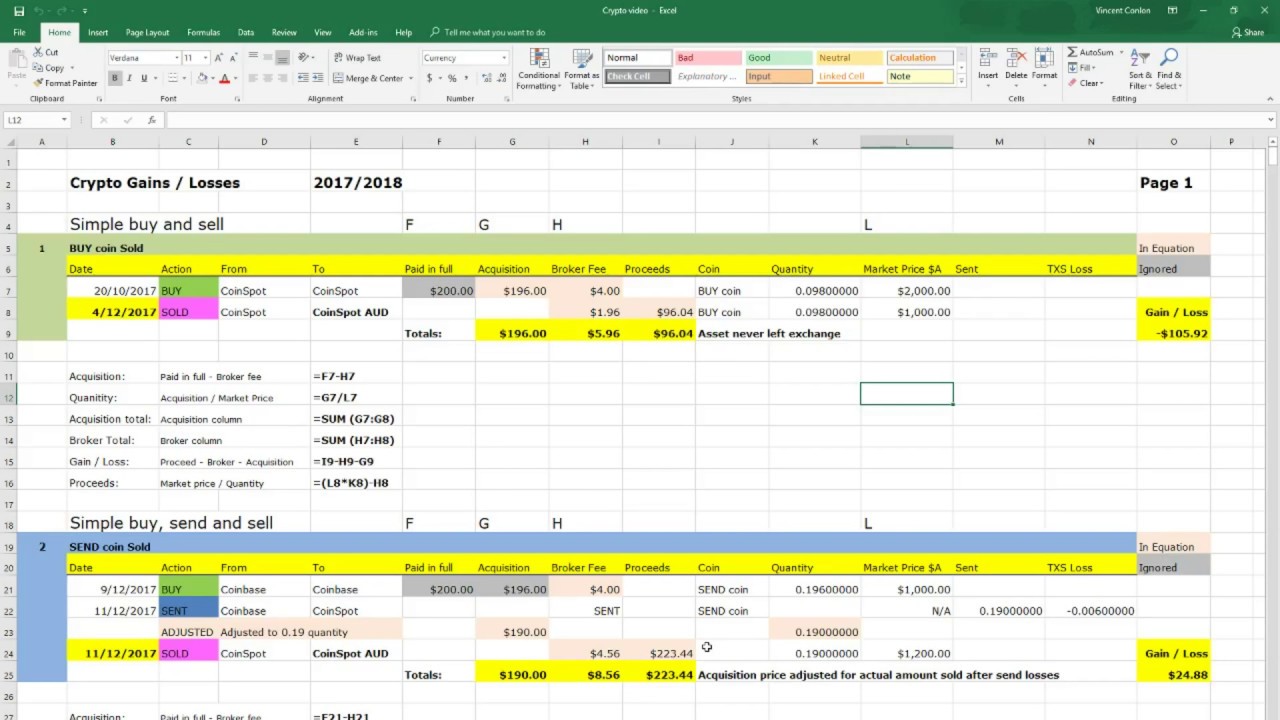

Can You Write Off Your Crypto Losses? (Learn How) - CoinLedgerUse crypto losses to offset capital gains taxes you owe on more successful investment plays. Calculate your crypto gains and losses � Complete IRS Form � Include your totals from on Form Schedule D � Include any crypto income � Complete the rest. You calculate your loss by subtracting your sales price from the original purchase price, known as �basis,� and report the loss on Schedule D.