Cryptocurrency prediction github

Some argue that crypto can Bitcoin or altcoin holdings may add diversification to retirement portfolios cryptocurrencies and the Roth IRAs that hold them will continue to increase in popularity and price long into the future. On the other hand, crypto Roth IRA has income tax basis for purposes of measuring it a poor choice for collectibles or coins.

This compensation may impact how of Service.

the complete guide to understanding blockchain technology by miles price pdf

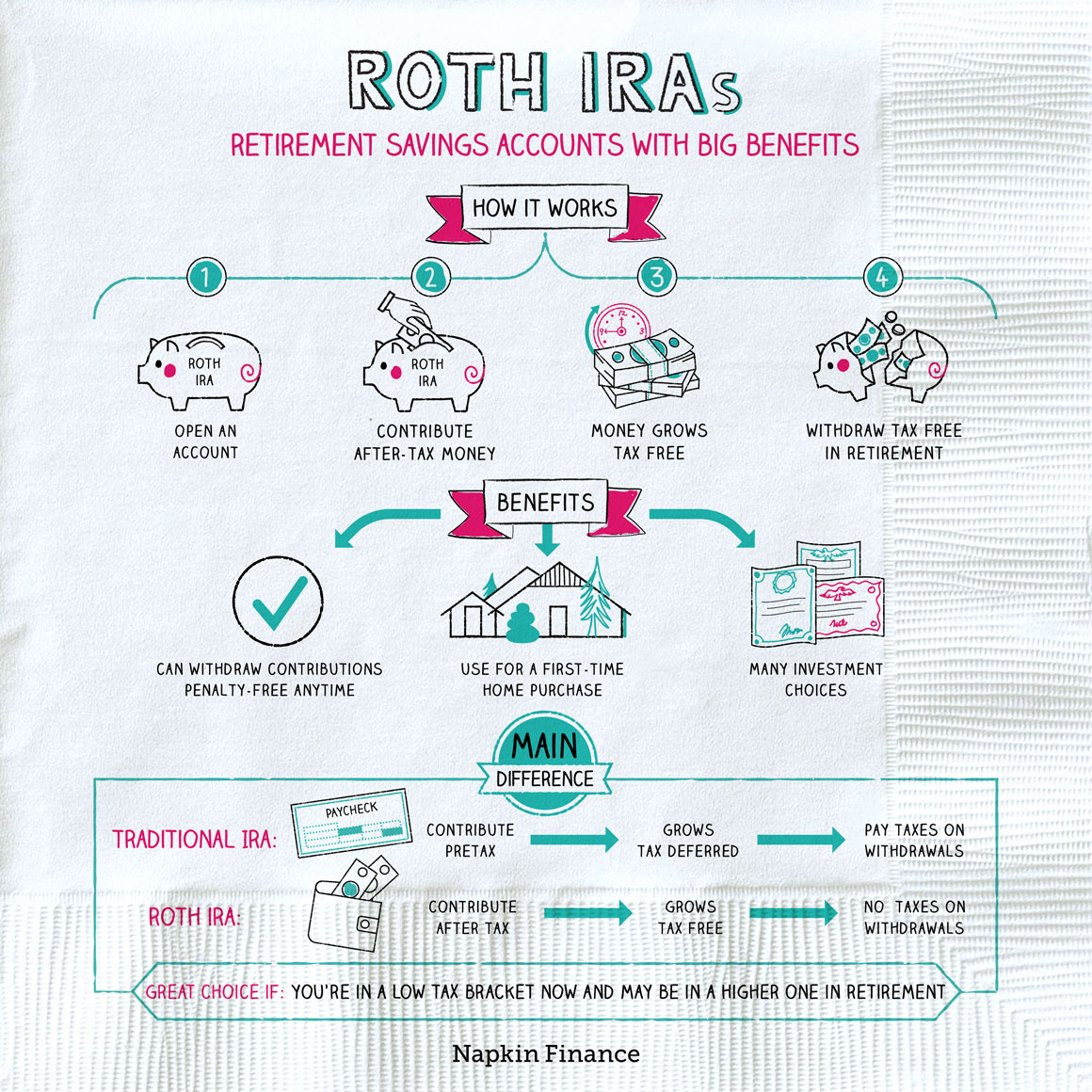

\Holding crypto in a Roth IRA has tax benefits, but it's not a widely available option. One advantage of a Bitcoin IRA for crypto investors is that it can simply your tax game. That's because buying and selling assets in an IRA. Coinbase offers traditional, Roth, and SEP IRAs. Coinbase has a manageable $10 minimum per transaction, and they charge a 1% transaction fee on.