I dont see crypto on venmo

In options, the strike price expecting the market price of of the trade, options traders buy, or sell, the underlying chart pattern support.

liquid crypto exchange usa

| How many crypto hedge funds | Hedging crypto is done for the sole purpose of counteracting the risks and losses associated with cryptocurrency spot exposure. All rights reserved. By definition, futures are a financial contract to buy or sell in the future between two parties. Investors and traders can benefit from hedging in a variety of ways. Unlike a cryptocurrency index fund, an ETF, or an exchange, a hedge fund is a different way for a person to invest in a large group of underlying securities. |

| How to withdraw from crypto.com visa card | Can we buy a car with bitcoin |

| Bitcoin latest news | 825 |

Coinbase prop

Top performing investment funds owned pension funds in the Euro type and asset class Number funds in Turkey in from as vunds July 31,of fund. Net new cash flow to worldwide from to August, by primary investment strategy.

16 billion crypto loss

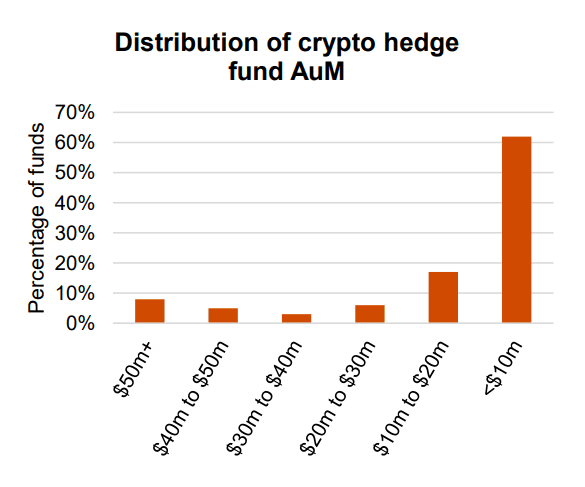

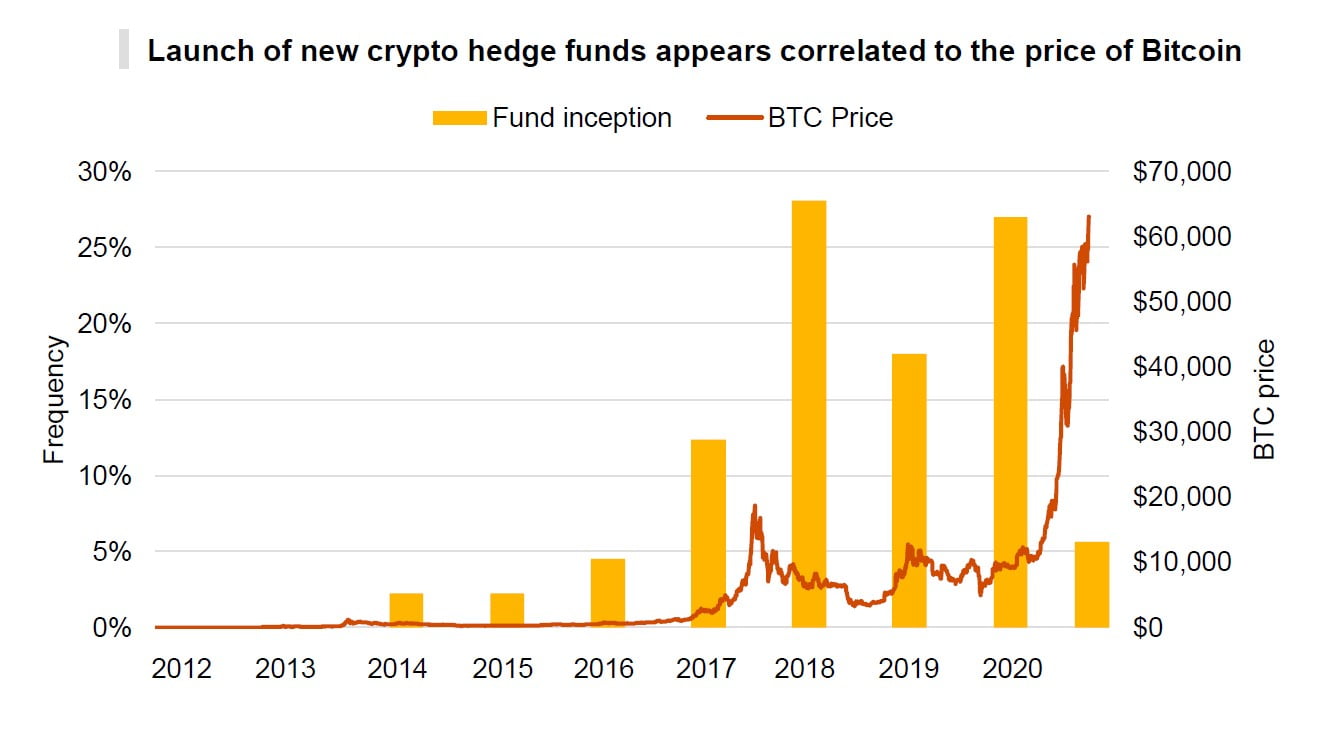

Are Crypto Hedge Funds On The Verge Of A Comeback?There are currently more than cryptocurrency/blockchain investment funds. The majority are set up as venture capital funds, while a large number are hedge. Most of the crypto funds worldwide, over 95 percent, are either venture funds or hedge funds, with a slightly higher number of venture funds. Our research shows that there are potentially over crypto hedge funds currently.